Food and drink firms in England and Wales are shrugging off the uncertainty that prevailed in the run-up to the EU referendum and showing an upbeat reaction to the UK’s decision to leave the European Union.

A report from Lloyds Bank Commercial Banking says despite the Brexit decision, food and drink firms have raised their growth forecasts. They plan to create over 75,000 new jobs over the next 5 years, enter new UK markets, and develop new products.

A survey of food and drink firms in England and Wales finds them upbeat following the Brexit decision, with revised plans to grow, create jobs, enter new markets, and develop new products.

A survey of food and drink firms in England and Wales finds them upbeat following the Brexit decision, with revised plans to grow, create jobs, enter new markets, and develop new products.

Lloyds Bank’s third annual survey of the food and drink sector shows the industry is forecasting 19 percent growth over the next 5 years – up 3 percent from 2015.

The study of English and Welsh producers of alcohol, fresh produce, and food and drink products, and conducted in the weeks following the EU referendum, was commissioned to examine the opportunities and challenges faced by UK food and drink manufacturers.

Among the challenges the report mentions the introduction of the National Living Wage, the proposed sugar tax, and the uncertainty surrounding the EU referendum.

However, despite these, the report says the sector remains upbeat. It finds that 95 percent of food and drink firms are expecting to grow in the next 5 years. This year, their investment plans are 5 percent higher than last year’s, rising from 38 percent of annual turnover to 43 percent.

Growth via collaboration

An emerging feature in the sector following the Brexit decision is an intention to grow via collaboration – 32 percent of food and drink firms surveyed said they were pursuing joint ventures.

Andrew Connors, Head of Client Propositions, Mid-Markets, at Lloyds Bank Commercial Banking, notes in the foreword to the report that is “heartening to see companies committed to creating jobs and finding creative ways to grow, in particular by coming together to collaborate and share the valuable skills that they have learnt.”

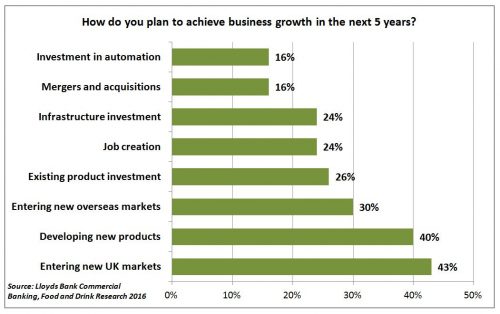

Food and drink firms plan to achieve business growth by a range of means, with many planning to enter new UK markets, develop new products, and create jobs.

Food and drink firms plan to achieve business growth by a range of means, with many planning to enter new UK markets, develop new products, and create jobs.

Another emerging theme, notes the report, comparing this year’s results with last year’s, is a potential shift in attitude to UK provenance. While it is seen as valuable, realizing it is a challenge.

Although food and drink firms still see UK provenance as an opportunity, and intend to continue publicizing it in their marketing and packaging, they are not seeing it improving business substantially.

Plans for overseas markets down, but poised

When asked if they were investing or planning to get new international customers, food and drink firms in this year’s survey showed lower figures compared to last year.

In 2015, around 72 percent of the sector said it was planning to engage new international customers – this year that figure has dropped to 55 percent.

The main reasons (all given an equal weighting of 29 percent) range from lack of funding, difficulties finding a suitable retail or distribution partner, complexity of logistics, and lack of knowledge of international markets.

However, the report notes that once these challenges are faced, over half (52 percent) of firms said they would speed up production rapidly should an opportunity to reach into an international market present itself.

Food and drink firms employ 400,000 people and contribute nearly £22 bn a year to the UK economy – nearly as much as the automotive and aerospace sectors combined.