The European Commission says it is carrying out an investigation to determine whether the German trade surplus is undermining Europe’s economic recovery. A trade surplus is when the value of all exports exceeds that of imports.

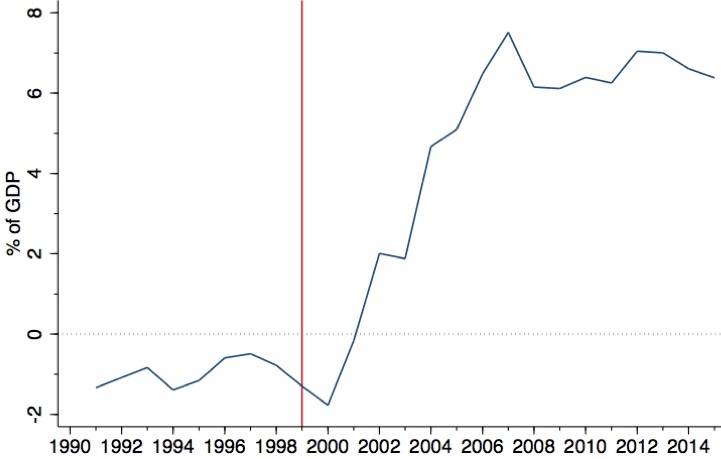

Germany’s trade surplus (current account surplus) amounts to 7% of its GDP (gross domestic product).

José Manuel Barroso, the European Commission’s president, said they wanted to find out whether Germany might be able to do more to help fix the European economy’s imbalance.

The European Commission also gave an assessment on the European Union’s fiscal consolidation, banks’ ability to restore lending, how growth and competiveness have become priorities since the crisis, unemployment and public administration.

The German trade surplus has recently been criticized by the US Treasury as being far too high and causing harm to both European and global economic growth.

German trade surplus as % of GDP since 1992

The International Monetary Fund soon followed, urging Chancellor Angela Merkel to bring it down to an “appropriate rate” so that some other Eurozone members might have a better chance to reduce their deficits.

Many find it strange that the US, which has run a trade deficit for decades as well as a budget deficit and has enormous debts, can preach to a country that manages to live within its means and makes products that sell well globally. The Bureau of Economic Analysis at the Commerce Department announced today (November 14th, 2013) that the US trade deficit for September grew to $41.8 billion, reaching a four-month high.

Why is the German trade surplus so high?

Olli Rehn, EU Economic and Monetary Affairs Commissioner wrote in his blog:

“On the one side, there are regular calls for the country to reduce its surplus through fiscal stimulus, to lift southern Europe from its doldrums. On the other side, in Germany these calls are often regarded as jealous attacks against the country’s extraordinary economic performance.”

Rehn went on to say that both points of view are extreme and bluntly simplify a complex reality. Germany has run a large current account surplus for many years, in fact it has exceeded 6% of GDP every year since 2007.

A key factor in this surplus has been the deepening of European integration since the beginning of the millennium. This has helped boost Germany’s competiveness in several ways:

- The euro – by being a Eurozone country, Germany could not have an appreciating currency which reflected its sizeable trade surplus.

- The integration of central and eastern European countries provided Germany with a large pool of highly-skilled and cheap workers.

- The integration of the financial markets and the convergence of interest rates drove international capital flows which grew alongside the current account surpluses.

A Eurosceptic may look at these arguments and say that is precisely why the UK refused to take on the euro as its currency. Unless your economy is completely synchronized to all the other Member States all the time, problems will emerge if you cannot devalue or appreciate your currency.

In other words, if another country is more or less successful than yours and you share the same currency, one of the two is going to suffer while the other will thrive.

German trade surplus the cornerstone of the nation’s economy

In Germany politicians from most parties rejected the European Commission’s concerns. Secretary General of the Christian Democrats (Angela Merkel’s party), Hermann Gröhe said that exports were the cornerstone of Germany’s prosperity.

The Executive Secretary of the Christian Social Union of Bavaria, Alexander Dobrindt, said “You cannot strengthen Europe by weakening Germany.”

Jens Weidmann, president of the Bundesbank (Germany’s central bank) said the positive knock-on effects of a more expansive German fiscal policy would be very limited for other Eurozone countries. Lowering the competitiveness of companies is not the answer to the German trade surplus, he added.

Sustaining Europe’s economic recovery a priority

In a communiqué today, the European Commission says that Europe’s greatest challenge today is to keep the current economic recovery going.

Barroso said:

“This is a turning point for the EU economy. The EU’s hard work is starting to pay off and growth is slowly coming back. The 2014 Annual Growth Survey points out where we need to be bolder to tackle reforms that are needed to build a lasting and job-rich recovery.”

Annual Growth Survey: A progress report

The European Commission says its Member States have made progress on each of the following five priorities:

- Modernizing public administration.

- Restoring bank lending to the Member State’s economies.

- Promoting competiveness and growth for today and tomorrow.

- Addressing unemployment and the crisis’ social consequences.

- The pursuit of differentiated, growth-friendly fiscal consolidation.

The European Commission proposes the same five priorities for next year “although with different areas highlighted for attention to reflect the changing EU and international economic environment”.

Fiscal consolidation

Budget deficits (average) in the EU have dropped by approximately 50% since a 7% of GDP peak in 2009. Debt levels, however, are expected to peak next year at nearly 90% of GDP.

Due to early action, Member States now have room to decelerate the pace of consolidation and concentrate more on “improving the quality of public expenditure and modernising public administration at all levels.”

Nations with more fiscal elbow-room need to stimulate consumption and private investment while maintaining long-term investment in climate protection, energy, research and innovation, and education. Taxes should be shifted from the workforce to pollution, property or consumption.

Restoring lending

The European Commission says market tensions have eased significantly since the middle of last year, and some progress has been made in fixing the financial sector.

Banks’ ability to manage risks will improve as a result of the EU’s efforts to build a Banking Union. However, more needs to be done to address private debt, which is very high.

Growth and competitiveness

The crisis has brought about a shift of focus across the whole of Europe towards more export-led growth. However, more needs to be done to open up services and product markets to competition, especially in the regulated professions and energy market.

There is a clear need to modernize research systems.

Unemployment and social developments

Member States’ efforts to modernize their labor markets should eventually help create more jobs and reduce unemployment.

Unemployed people need more active support in training so that their chances of finding work improves.

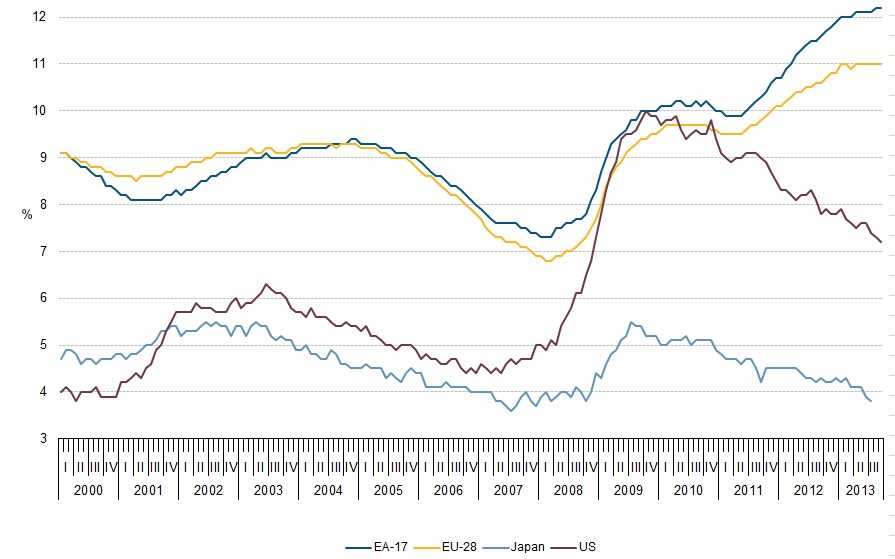

Unemployment in Europe, Japan and the United States

Public administration

A number of European Union Member States are trying to make their public sectors more efficient “including by improving cooperation between different layers of government. The focus should be on shifting public services online and reducing red tape.”