Indian GDP growth in the second quarter of 2013 of 4.8% was higher-than-expected, and better than the 4.4% recorded in the first quarter.

A Wall Street Journal poll of 17 economists had expected 4.6% growth for Q2.

Indian GDP growth data are published by the Central Statistics Office at the Ministry of Statistics and Programme Implementation.

Indian GDP growth had slowed down considerably as its currency fell in value, foreign investment declined and inflation picked up. First quarter growth was the lowest since 2009.

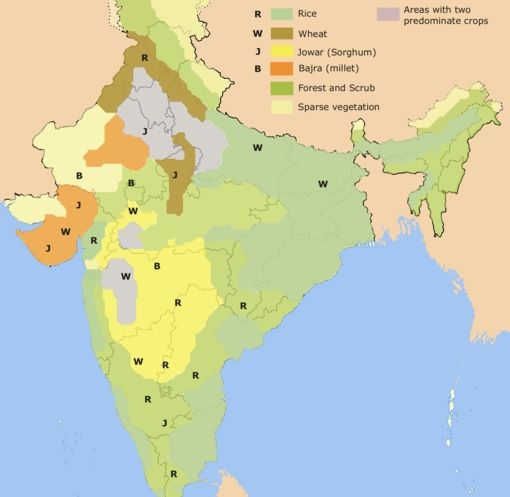

Farm output has been boosted by a good season of monsoon rains, while the decline in the rupee has helped reduce the country’s current account deficit.

The prime minister’s economic advisory expects growth for 2013 to reach just 5.3% this year. The IMF (International Monetary Fund) forecasts growth of just 4.3% for the fiscal year to March.

Monsoon rains have boosted agricultural production.

Indian GDP growth for 2013 likely lowest since 2003

In the last financial year ending in March 2013, Indian GDP growth slowed to 5%, compared to 9.3% two years before. If Indian GDP growth this year slips below 5%, which seems likely, it will be the first time it has done so since 2003.

Several factors have undermined the Indian economy this year, including a slowdown in manufacturing and mining. Manufacturing grew by just 1% in the second quarter.

As advanced economies’ GDPs have started to show clear signs of economic recovery, especially the USA’s, investors have moved away from India.

Expectations that the US Federal Reserve will likely soon start scaling back its pumping of $85 billion into the financial system every month has resulted in investors pulling out of emerging markets, such as Brazil, Indonesia and India.

This capital exodus hit the rupee, which fell in value against the dollar by 25% during the first nine months of this year. Over the last couple of months the rupee has gained back some of its value, and now stands 13% below its January 2013 dollar parity.

A lower currency makes imports more expensive, which in turn drives up the rate of consumer inflation. Inflation reached 9.84% in September and then rose to 10.1% in October.

The central bank responded to rising inflation by increasing its benchmark rate to 7.75% in October. Other BRIC-type countries are experiencing similar problems. The Brazilian Central Bank hiked its Selic interest rate to 10% earlier this week.

Arvind Mayaram, Economic Affairs Secretary, said of the official figures:

“I have been saying that growth will come back slowly in third and fourth quarter. But I am glad that it is better than the first quarter. There were many people who were predicting that it will be less. So I believe that going forward in third and fourth quarters, you would see a pick up… (GDP growth in the) fiscal 2013-14 would be upwards of 5 per cent.”

Director-general of the Confederation of Indian Industry, Chandrajit Banerjee, said:

“The growth of GDP at sub-5 per cent level for the fourth consecutive quarter is worrisome. The two drivers of growth this year – good monsoons and exports – are insufficient to pull the economy out of the present slowdown, as mining, manufacturing and service sector output remain subdued.”

Initial signs of an economic rebound?

A number of economists see the latest higher-than-expect Indian GDP growth for Q2 as possibly the initial signs of an economic rebound.

The Wall Street Journal1 quotes Abheek Barua, chief economist at HDFC Bank, who said “We might not see a spectacular recovery but we might see better performance in the second half [of the fiscal year] if these trends continue.”

Below are some highlighted data on how different sectors fared during the second quarter of 2013:

- Agriculture +4.6%

- Manufacturing +1%

- Electricity, Gas and Water +7.7%

- Construction +4.3%